How Biometric Security and IoT are Shaping the Future of Mobile Payments

Biometric security and the Internet of Things (IoT) are revolutionizing mobile payment systems. These advancements bring stronger, more seamless authentication methods, making mobile payments more secure and user-friendly. This article explores how these technologies are transforming mobile payments, enhancing security, and improving user experience.

The Role of Biometric Security in Mobile Payments

Biometric security, which includes fingerprint scanning, facial recognition, and voice recognition, has become a key factor in mobile payment security. By using unique physical characteristics for authentication, it offers a higher level of protection compared to traditional passwords or PINs. As a result, customers can make secure payments without worrying about identity theft or fraud.

Biometric technology is growing in popularity as more smartphones and mobile devices integrate fingerprint sensors and facial recognition capabilities. As this technology evolves, it will provide even more reliable and convenient authentication methods. Learn more about biometric security innovations here.

IoT’s Impact on Mobile Payments

The Internet of Things (IoT) connects devices and enables seamless communication between them. This connectivity has opened new doors for mobile payments, allowing users to make transactions with various IoT-enabled devices, including wearables, smart home devices, and even vehicles.

For example, IoT-enabled payment systems allow users to make contactless payments directly from their smartwatches or other wearable devices. As IoT adoption continues to grow, mobile payments will become more integrated into daily life, making it easier and faster for users to pay on-the-go.

To dive deeper into IoT’s role in mobile security, check out our detailed article on IoT in mobile payments.

Combining Biometric Security with IoT for Enhanced Payment Systems

By integrating biometric security with IoT devices, companies can create even more secure mobile payment systems. For instance, IoT-enabled devices like smartwatches can use facial recognition or fingerprint scanning to verify the user’s identity before processing payments. This combination offers a highly secure, frictionless experience for users.

As more retailers and service providers adopt this technology, we can expect greater trust in mobile payments, encouraging further adoption worldwide. This collaboration between IoT and biometric security creates a robust payment ecosystem that is difficult to breach.

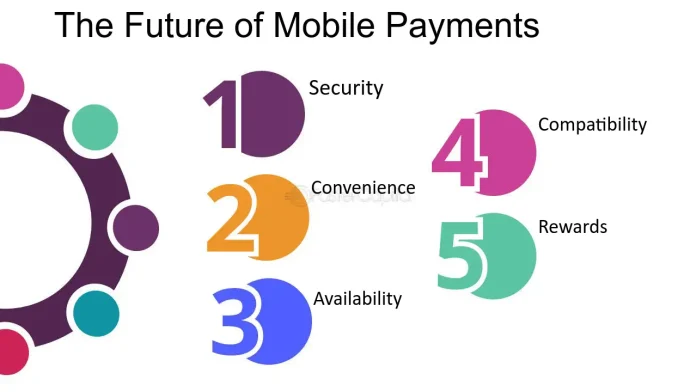

Future of Mobile Payments: What to Expect

As both biometric security and IoT technologies continue to evolve, mobile payments will become more secure, convenient, and user-friendly. For example, future advancements might include multi-factor authentication combining biometrics and IoT-based location data, ensuring even higher levels of security.

In addition, as AI and machine learning are integrated into payment systems, they will be able to analyze user behavior patterns, providing even more robust fraud detection mechanisms. These innovations will further enhance the security of mobile payments, leading to more widespread adoption across industries.

Discover more about the future of mobile payment systems and IoT integration.

Conclusion

Biometric security and IoT are playing pivotal roles in shaping the future of mobile payments. By providing enhanced authentication and integrating IoT-enabled devices, these technologies ensure a secure and seamless payment experience. As these innovations continue to advance, we can expect mobile payments to become even more secure and convenient, benefiting both consumers and businesses alike.

Explore the full article about the IoT.

The Impact of IoT on the Evolution of Smart Building Platforms

Bureau Veritas Grants Type-Approval to IoT Cybersecurity Solution